Automate Paid-When-Paid in Workday and Protect Your Cash Flow

In project-based industries such as construction and professional services, paid-when-paid (PWP) clauses are often built directly into subcontractor agreements. These terms allow organizations to delay payment to their vendors until they receive the corresponding payment from their customers.

Even with these clauses in place, the real challenge lies in consistently enforcing them in Workday. Today, tracking these payment dependencies typically relies on spreadsheets, emails, and ad-hoc invoice holds. This creates additional manual effort and makes it harder to ensure subcontractor payments are aligned with incoming customer payments.

The result? Lost time, financial discrepancies, funding gaps, strained supplier relationships, and risky workarounds that auditors hate.

This challenge cuts across nearly every operational and financial role in project-driven businesses:

CFOs

Early supplier payments drain working capital and increase exposure to cash shortages. CFOs need mechanisms that protect liquidity without interrupting delivery.

Accounts Payable Managers

AP teams spend hours sorting through invoices, tracking exceptions, and confirming which payments can be released. The manual nature of this process introduces errors and supplier frustration.

Project Managers

Projects rely heavily on subcontractor networks. Without clear visibility into customer-payment dependencies, budgets become unpredictable, and disputes arise.

Financial Controllers

Manual tracking creates compliance blind spots, unreconciled payment trails, and audit issues, all of which are exacerbated in industries with complex billing milestones.

Each role faces the same root issue: the lack of an automated, reliable way to drive supplier payments from related cash receipts in Workday.

Introducing Paid When Paid by Makse Group

The Paid When Paid app was designed to resolve this exact challenge. Built natively with Workday Build tools, the app enforces payment discipline by ensuring supplier invoices are only released after corresponding customer payments are received.

Instead of chasing approvals or managing offline trackers, teams gain full automation, visibility, and control over payment dependencies.

How It Works for You

Automated Invoice Holds: Supplier invoices with “paid-when-paid” terms are automatically placed on hold after approval until the associated customer invoice is paid

Seamless Release on Customer Payment: Once cash receipts are applied to the customer invoice, the Paid When App app instantly matches them with related supplier invoices and automatically releases the payment hold.

Centralized Dashboard: Finance teams are given a unified view of all customer-supplier dependencies, enabling faster, more transparent decision-making.

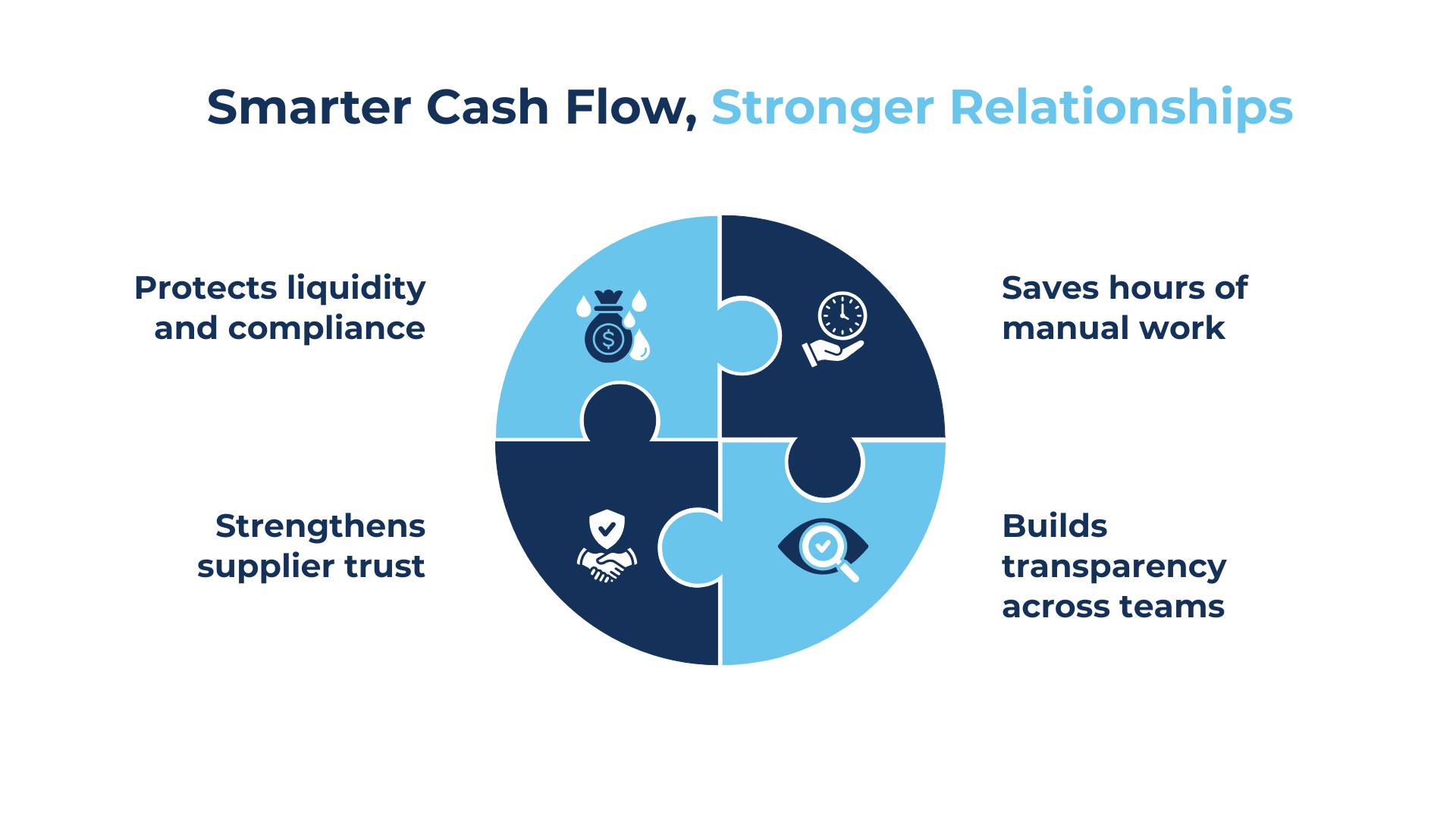

The Benefits That Matter

Protects Cash Flow: Ensures timely allocation of customer payments, safeguarding your company’s working capital.

Boosts Operational Efficiency: Reduces manual tracking by eliminating spreadsheets, emails, and ad hoc approvals.

Strengthens Supplier Relationships: With accurate, timely payments, vendors remain satisfied and reliable partners.

Improves Accuracy & Compliance: Establishes a rule-driven, fully auditable process within Workday.

The result? Finance leaders gain peace of mind, AP teams save hours of manual work, and organizations enhance both supplier and customer trust with timely, transparent payments.

Closing Thought

A healthy supplier network is the backbone of resilient operations. With Paid When Paid, organizations can turn cash receipts into a clear signal for supplier payments, maintaining strong relationships without putting pressure on working capital. It’s not just about automation; it’s about creating financial practices that scale with your business.

The app is available on the Workday Marketplace. Explore how it can fit into your workflows and start strengthening supplier relationships with automation that works where you work.